Retirement: J.P. Morgan Studied 5 Million Retirees - Here Are The 3 Shocking Spending Surprises!

You're working and saving for retirement. At some point the light bulb in your head goes off and you start asking yourself these questions:

- When can I retire?

- How much money do I need to retire?

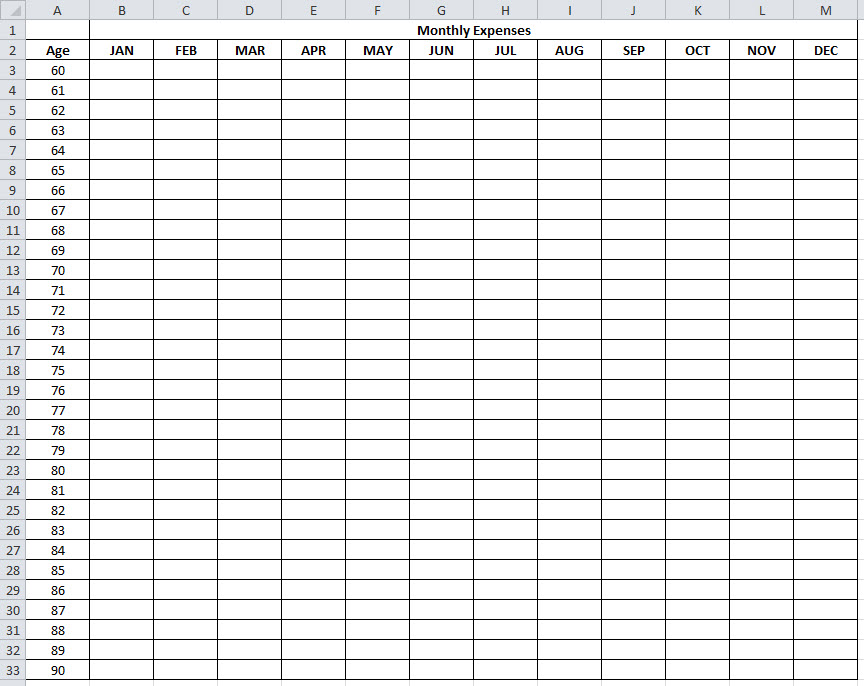

A critical part of the answer lies in this spreadsheet:

When I first started thinking about retirement, looking at a spreadsheet like this was very eye-opening. Not too many rows left. The 30-year retirement doesn't look very long.

Can you estimate your future spending till death? If you have a spouse, can you estimate their spending too?

Some spending seems easy. Monthly bills. Taxes. Insurance. Maybe you'll have a house payment for part of that time. These things are pretty consistent, but will increase with inflation over time.

Have you got children who will attend college? How about weddings?

You'll want a fresh car at some frequency.

How about house renovations?

The last few years can be difficult to predict. Assisted or nursing care can be expensive.

In the following video, J.P. Morgan studies the spending of retirees. There's a good chance you might see some surprises in their analysis. Maybe this information will help you with your future spending estimate?