Retirement: Insurance Information for 2026

This is not going to be a very interesting note. More like a historical record.

Corning retirees, at least retirees like me who have a spouse under age 65, received a brochure that is essentially our benefit selection process for 2026. Thankfully no real action is required to continue with the same Pre-65 health care insurance. Looks like Corning is moving mail-order prescription processing from Caremark to Optum RX, so that will be a change for my wife. Not clear how that transition will happen but the brochure makes it look like it will be simple and we will hear more later this year.

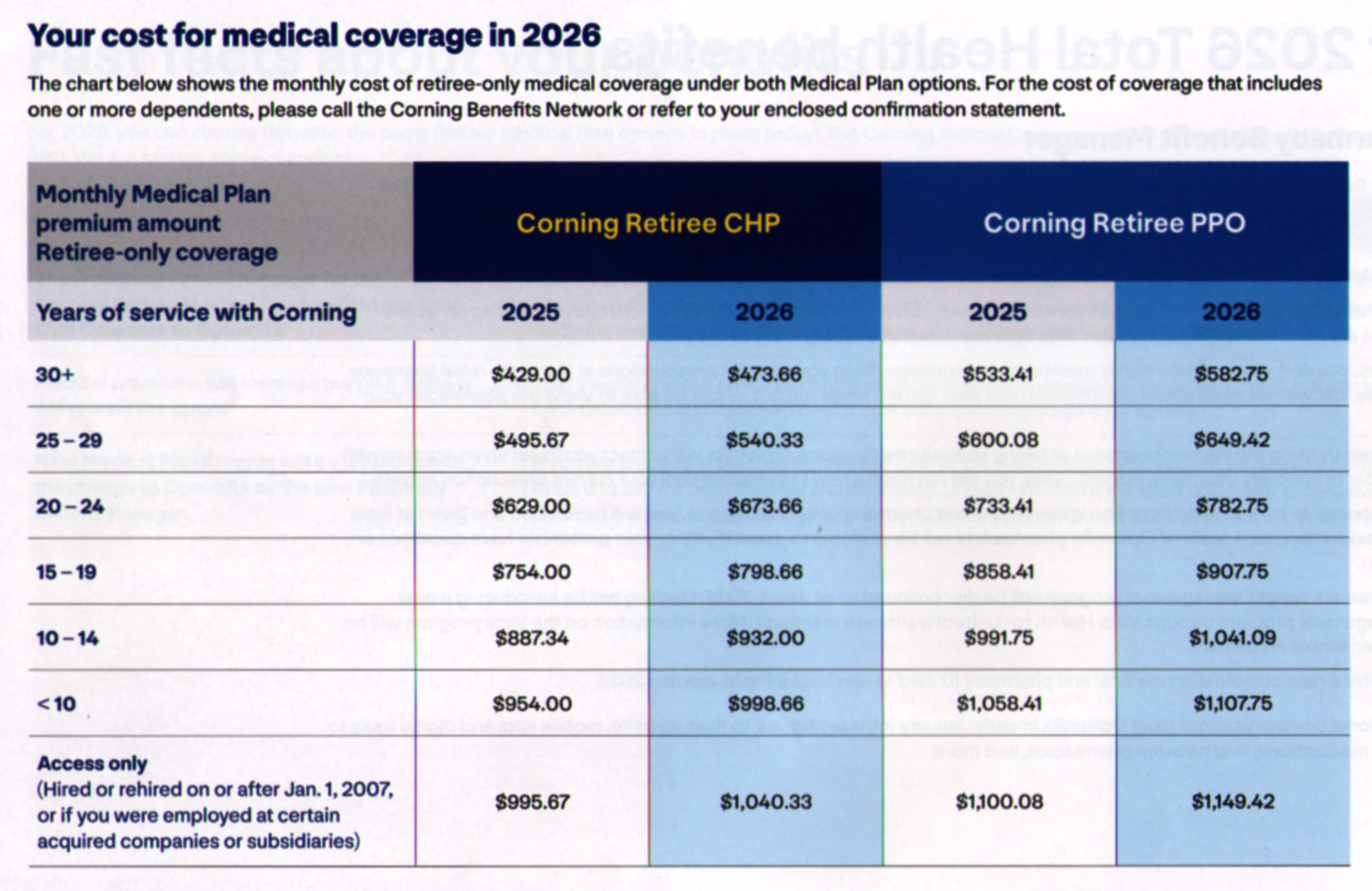

For people planning to retire, here's a small data point on the cost of Pre-65 retiree health insurance. From the brochure:

The brochure also mentions Met Life Takealong Dental insurance, which I've mentioned a few times, and EyeMed for vision insurance, which I wasn't aware of. I've included their websites below.

https://www.metlifetakealongdental.com

https://eyemed.com/en-us/member/individual

On the Medicare side, I'm trying to pay attention so I don't miss anything.

The AARP/UHC website says my current Medigap Plan N plan will continue for 2026, but I don't see pricing anywhere. My 2025 premium is $95.39 per month. I'm guessing $102 per month for 2026 based on an estimate for a new customer. I assume I'll hear something about the new premium later in 2025.

For the Part D drug plan, open enrollment starts October 15th and ends December 7th. I assume this is more important because drug plans seem more volatile. For example, the drug plan I'm on in 2025 might not be offered in 2026. I went to the AARP/UHC website, logged in and looked around. Here are some things worth noting:

-

My current 2025 drug plan monthly premium is $93.20. I see on the website this premium is going up to $119.80.

-

For 2025, I had 3 drug plan choices. For 2026 there are only 2 plans. I saw an interesting YouTube video recently that explains how the number of providers and plans is consolidating. The other plan choice will cost $56.90 per month.

-

The AARP/UHC website does an excellent job of comparing costs if you enter the prescription drugs you're taking. For 2025 I had added a "Tier 4" drug I was using, which made the 2 most likely plans cost about the same. I went another way with that medication. Now the lower cost plan looks much better. Premiums lower. Higher cost for drugs. I will save at least $300 in 2026, unless some new prescription pops up.